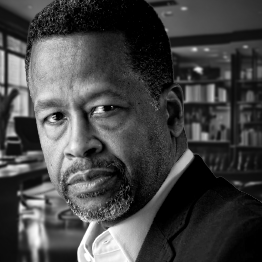

Hakim Dyer

Strategic Advisor | Capital Fluency | Business Operational Command

A pattern I've observed across 38 years and multiple economic cycles:

Two founders. Same business model. Similar traction. Both pitch the same investor.

Founder A: "We're building toward profitability. We'll optimize unit economics once we reach scale."

Founder B: "Here's our cohort performance. Payback period is 11 months. We're capital efficient by design, not by accident."

Guess which one closed.

This distinction repeats endlessly. Not just in fundraising. In board meetings. In strategic planning. In hiring. In pricing decisions. In every conversation where financial command matters.

The difference isn't intelligence. It's not even experience. It's operational fluency — the ability to articulate the financial logic of your business under pressure.

Where most CEOs struggle:

They can pitch vision. They can sell customers. They can manage teams. But ask them to defend their pricing strategy to a skeptical board member, and the confidence evaporates. Ask them to explain unit economics in detail, and you get "we're still finalizing that analysis."

The business might be solid. The team might be strong. But without demonstrable financial command, the capital conversation stalls.

38 years taught me this: Investors evaluate two things before anything else: whether the business works, and whether the CEO commands it. The pitch deck is tertiary. The narrative is decoration. What matters is operational mastery most readily visible through financial fluency.

What operational command actually means:

You can articulate unit economics without consulting spreadsheets

You defend pricing strategy with confidence, not hope

You explain the path to profitability with investor-grade precision

You govern through variance analysis, not gut feel

You discuss valuations calmly because you understand the mechanics

This isn't CFO knowledge. It's executive-level strategic capacity.

The work:

I advise CEOs who recognize this gap. Those who need to demonstrate financial command before their next capital conversation, board meeting, or strategic inflection point. We work the fundamentals: pricing architecture, margin structure, capital efficiency, cohort performance, and the operational logic that makes businesses investable.

Think peer-level strategic advisory. Someone who's operated at institutional grade— international banking, community finance, real estate capital, CFO leadership —and now works with operators who need to command at that level.

The "&Co" represents 100+ ProfitAdvisors plus deep ecosystem connections. When patterns require specialized expertise beyond my direct experience, the network activates. Strategic bench strength that extends beyond any single advisor.

The market evaluates command, results, and profit. Either you demonstrate it, or you're still building toward it. There's no third option.